Tax Brackets 2025 Federal Married. Federal tax brackets 2025 married. Previous tax year (2025) tax year 2025 / filed april 2025.

Here in the u.s., we have what’s called a progressive tax system. Edited by patrick villanova, cepf®.

Use The New Tax Brackets to Minimize 2017 Taxes, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married. See current federal tax brackets and rates based on your income and filing status.

Federal Tax Revenue Brackets For 2025 And 2025 Nakedlydressed, Married filing jointly, surviving spouse: See the tax rates for the 2025 tax year.

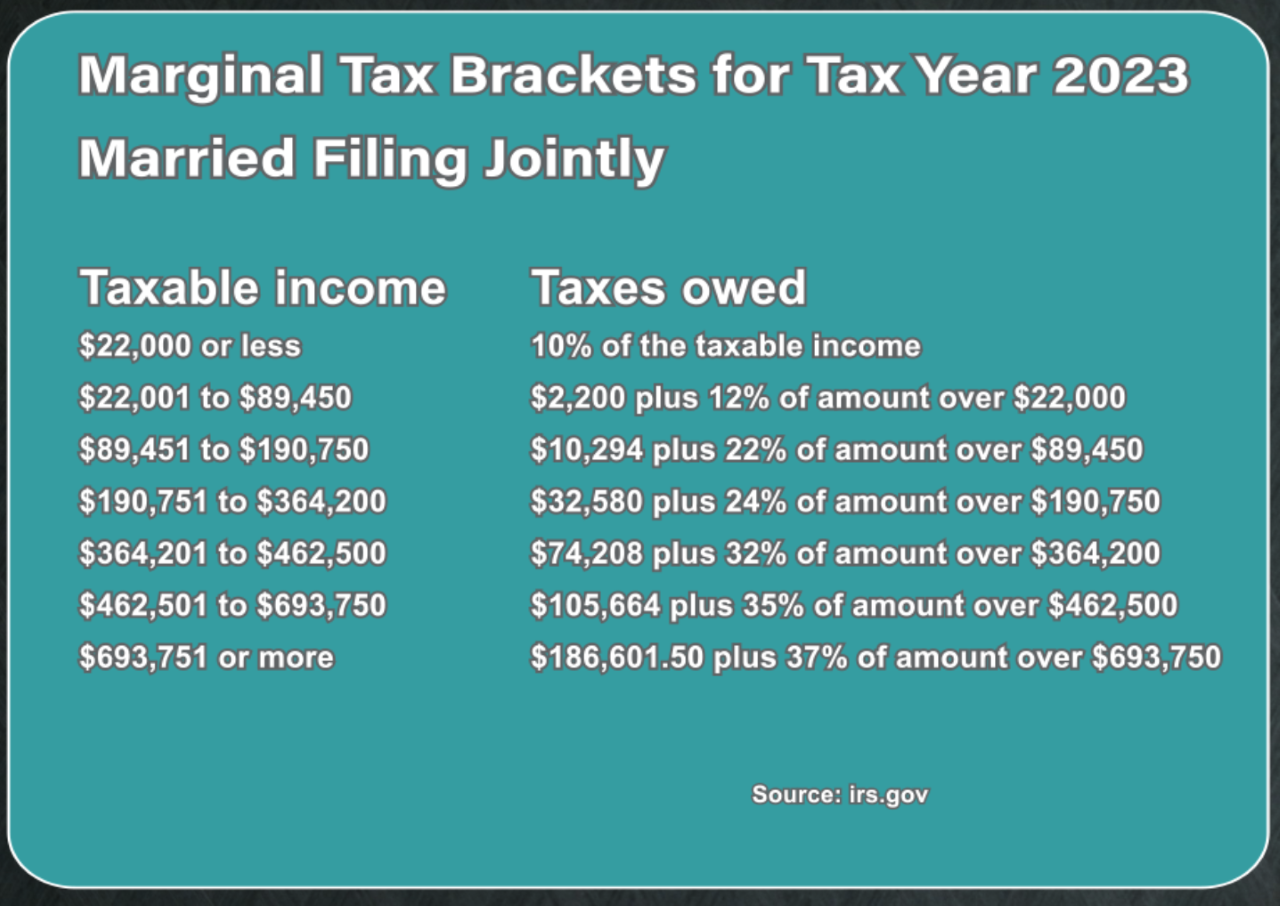

2025 Us Tax Brackets Irs Rezfoods Resep Masakan Indonesia, Federal tax brackets for 2025 and 2025 r/thecollegeinvestor, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket is determined by how much taxable income you receive each year.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Tax brackets for income earned in 2025. Federal tax brackets 2025 married.

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation. Federal withholding tables 2025 federal tax, the below brackets or rates are for tax year 2025.

Irs Withholding Rates 2025 Federal Withholding Tables 2025, 2025 and 2025 tax brackets and federal income tax rates. Updated on december 16, 2025.

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, There are seven federal tax brackets for tax year 2025. 2025 federal income tax brackets and rates for taxable income.

2025 Tax Brackets Married Filing Jointly California Kitchen, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 California Tax Brackets W2023H, Edited by patrick villanova, cepf®. Here in the u.s., we have what’s called a progressive tax system.

IRS Tax Brackets AND Standard Deductions Increased for 2025, The table below shows the tax brackets for the federal income tax, and it reflects the. See the tax rates for the 2025 tax year.

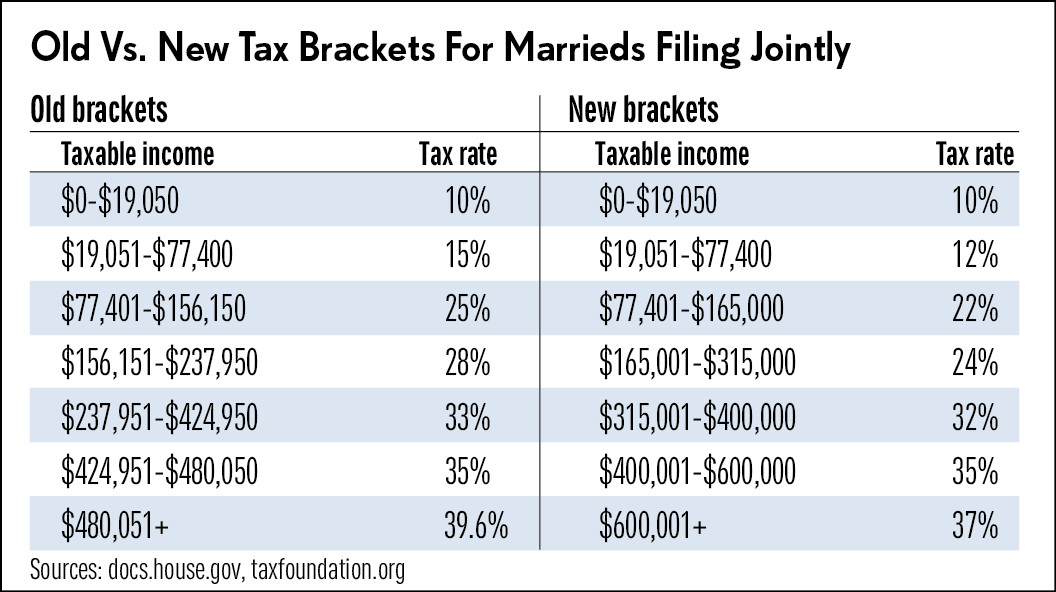

The federal income tax consists of seven marginal tax brackets, ranging from a low of 10% to a high of 39.6%.

The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation.