Farmers Tax Return Due Date 2025. Currently, taxpayers in most of california and parts of alabama and georgia, have until oct.16, 2025, to file their 2025 return and pay any tax due. Farmers and fishermen who didn’t pay all estimated tax payments must file an income tax return and pay any tax due by march 1 to avoid penalty.

Know who is eligible, how to pay, and the consequences of missing the deadline. Farmers and fishermen who didn’t pay all estimated tax payments must file an income tax return and pay any tax due by march 1 to avoid penalty.

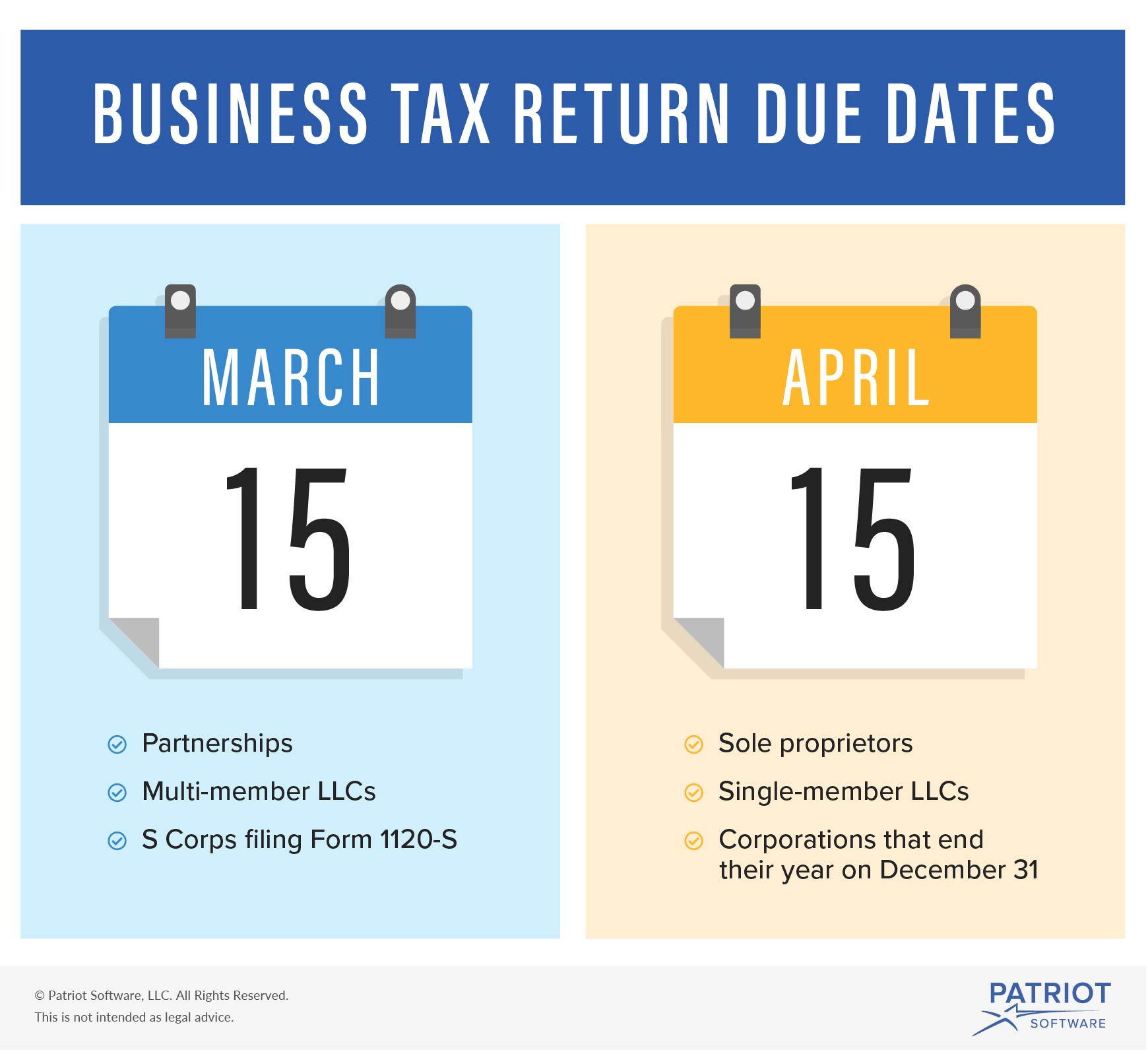

Estimated tax payments for all calendar year taxpayers except farmers and fishers are due on the 15th of april, june, september and january of the following tax year.

Farmer Tax Guide YouTube, The average refund size is up by 5.8%, from $2,972 for 2025's tax season through march 10, to $3,145 for this. In 2025, several changes have been made to farm tax laws that farmers should familiarize themselves with.

Gregory, Harriman & Associates Return of Fuel Charge Proceeds to, Federal individual tax rates on ordinary income (10%, 12%, 22%, 24%, 32%, 35%, and 37%—and there is also a zero rate) didn't change in 2025, but the individual. Most of the due dates.

Tax Return filing for AY 2324.File Your ITR With Ezeepay.Last, Pay your advance income tax before 15 march 2025 to avoid penalties. If you file forms 8027 electronically, your due date for filing them with the irs is march 31, 2025.

Tax Return Due Date Extension AY 202324 Why tax filers wait, Use the calendar below to track the due dates for irs tax filings each month. Know who is eligible, how to pay, and the consequences of missing the deadline.

Small Business Tax Preparation Checklist How to Prepare for Tax Season, The average refund size is up by 5.8%, from $2,972 for 2025's tax season through march 10, to $3,145 for this. March 1 is often labeled the “farmer due date.” it’s not a due date for tax returns, but it feels like one.

Tax India on Twitter "Have you filed your ITR yet? Due date to, Washington — the internal revenue service today reminded farmers and fishers who chose to forgo making estimated tax payments by january that they must generally file their 2025 federal income tax return and pay all. The average refund size is up by 5.8%, from $2,972 for 2025's tax season through march 10, to $3,145 for this.

Four days to ITR 202122 filing deadline Don't to everify your, If you file forms 8027 electronically, your due date for filing them with the irs is march 31, 2025. Unless otherwise noted, the dates are when the forms are due to.

TAX RETURN DUE DATE FY 202122 (AY 202223),WILL ITR DUE DATE, For the tax years 2025 and 2025, however, the usual submission deadlines have been pushed back. Farmer's due date is april 15;

No Extension For Tax Return Due Date 2025, For the tax years 2025 and 2025, however, the usual submission deadlines have been pushed back. Washington — the internal revenue service today reminded farmers and fishers who chose to forgo making estimated tax payments by january that they must generally file their 2025 federal income tax return and pay all.

Tax Return 2025 Chart Printable Forms Free Online, These changes aim to provide better support and opportunities for. Farmers and fishermen pay estimated tax for 2025.

However, if they file and pay by march 1 they are not required to make any estimated income tax payment on january 15.