Corporate Transparency Act 2025 In Texas. Reporting companies that are in existence on the effective date must file. The corporate transparency act (cta) has been a hot topic for small business owners since its inception. The corporate transparency act, will impose new significant reporting requirements for many u.s.

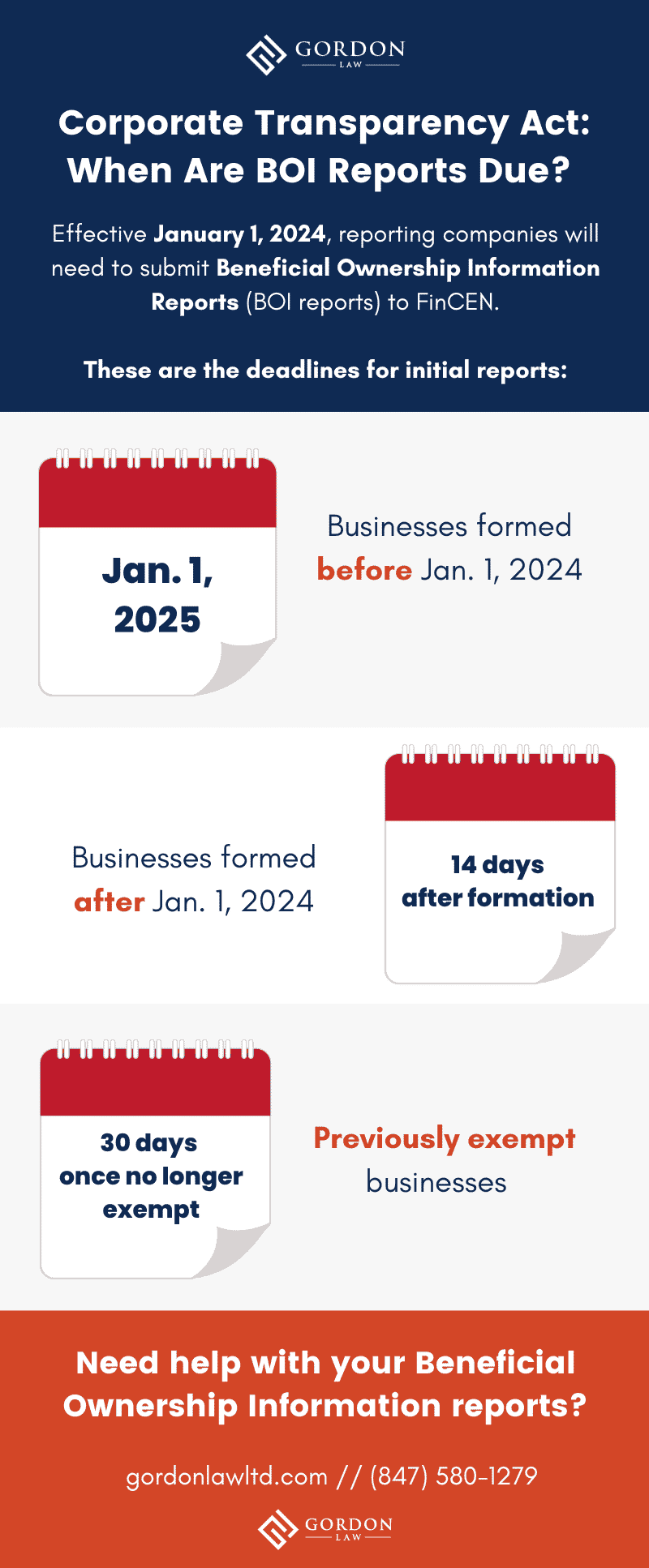

Businesses that form in 2025 have 90. A new federal law, the corporate transparency act, recently went into effect as of january 1, 2025, and has serious implications for many hotel.

Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s.

Everything you need to know about the Corporate Transparency Act for, Entities to register in 2025 with fincen. Businesses that form in 2025 have 90.

Corporate Transparency Act What You Need to File and When, This article provides an overview of the act and its implications for businesses operating in. Effective january 1, 2025, most new and existing corporate entities in the united states will be required to file reports on their beneficial owners with the.

The Corporate Transparency Act—What You Need to Know CSC, Corporate transparency act beneficial ownership reporting is here by jeff dodd on february 6, 2025. The corporate transparency act is a recent legislation in texas that aims to increase corporate accountability and transparency.

Corporate Transparency Act Companies to report ownership information, Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s. Businesses that form in 2025 have 90.

Corporate Transparency Act Understanding Reporting Requirements, Many companies are required to report information to fincen about the individuals who ultimately own. A new federal law, the corporate transparency act, recently went into effect as of january 1, 2025, and has serious implications for many hotel.

The US Corporate Transparency Act What’s New? [December 2025], The cta requires reports of beneficial ownership information (boi) and is estimated to affect more than 32 million existing entities (even after. Corporate transparency act requires small businesses to disclose beneficial ownership.

Corporate Transparency Act (CTA) Effective January 1, 2025 YouTube, The corporate transparency act, will impose new significant reporting requirements for many u.s. Entities to register in 2025 with fincen.

![The US Corporate Transparency Act What’s New? [December 2025]](https://shuftipro.com/wp-content/uploads/us-coporate-transparency.jpg)

Corporate Transparency Act What Every Business Needs to Know Prior to, The corporate transparency act (cta) has been a hot topic for small business owners since its inception. The corporate transparency act is a recent legislation in texas that aims to increase corporate accountability and transparency.

Corporate Transparency Act New beneficial ownership reporting, Reporting companies that are in existence on the effective date must file. The corporate transparency act is a recent legislation in texas that aims to increase corporate accountability and transparency.

Corporate Transparency Act Reporting Rules Effective January 1, The reporting requirement began on jan. By now, cpas should be aware of the corporate transparency act (cta), passed in 2025 and effective january 1, 2025.

The corporate transparency act is a recent legislation in texas that aims to increase corporate accountability and transparency.